Background

Think about the last time you heard about a new hit TV show. Or noticed a friend wearing the latest fashion. You might have rushed to watch that show or buy that fashionable good while it was still popular.

For consumers, this behavior is common; today, tiny brands can reach viral fame quickly [1]. But is this behavior similar to how venture capitalists invest in start-ups? In other words, do venture capitalists – and private equity investors more broadly – rush to invest in a technology after it starts generating publicity and ‘hype’? And if so, how much time do entrepreneurs have to raise funds before the wave of investment subsides?

Consider the most recently hyped technology: ChatGPT and its underlying generative artificial intelligence. Following its release to the public, the Economist reported that investors were “going nuts for ChatGPT-ish artificial intelligence” with one venture capitalist referring to a “Cambrian explosion” in the field [2].

When I read the article, it made me question my notions about venture capital. Weren’t these investors supposed to be industry experts, with knowledge of emerging technologies before the general public? Weren’t their investments in early-stage start-ups supposed to foster subsequent hype, rather than the reverse?

My analysis below attempts to answer these questions and provides guidance to entrepreneurs seeking to leverage the momentum from hype in technologies.

Summary

I find that for ten recent technologies, a wave of seed fundraising lagged the first major hype moment by an average of 9.4 months (+/- 15.8 months). To determine this, I compared Crunchbase data on early-stage funding rounds to Google Trends search results. The ten technologies I chose in my sample were:

- Cyber security

- 3D printing

- Big data

- Quantum computing

- Internet of Things (IoT)

- Virtual Reality

- Artificial Intelligence

- Cryptocurrency

- Metaverse

- Web3

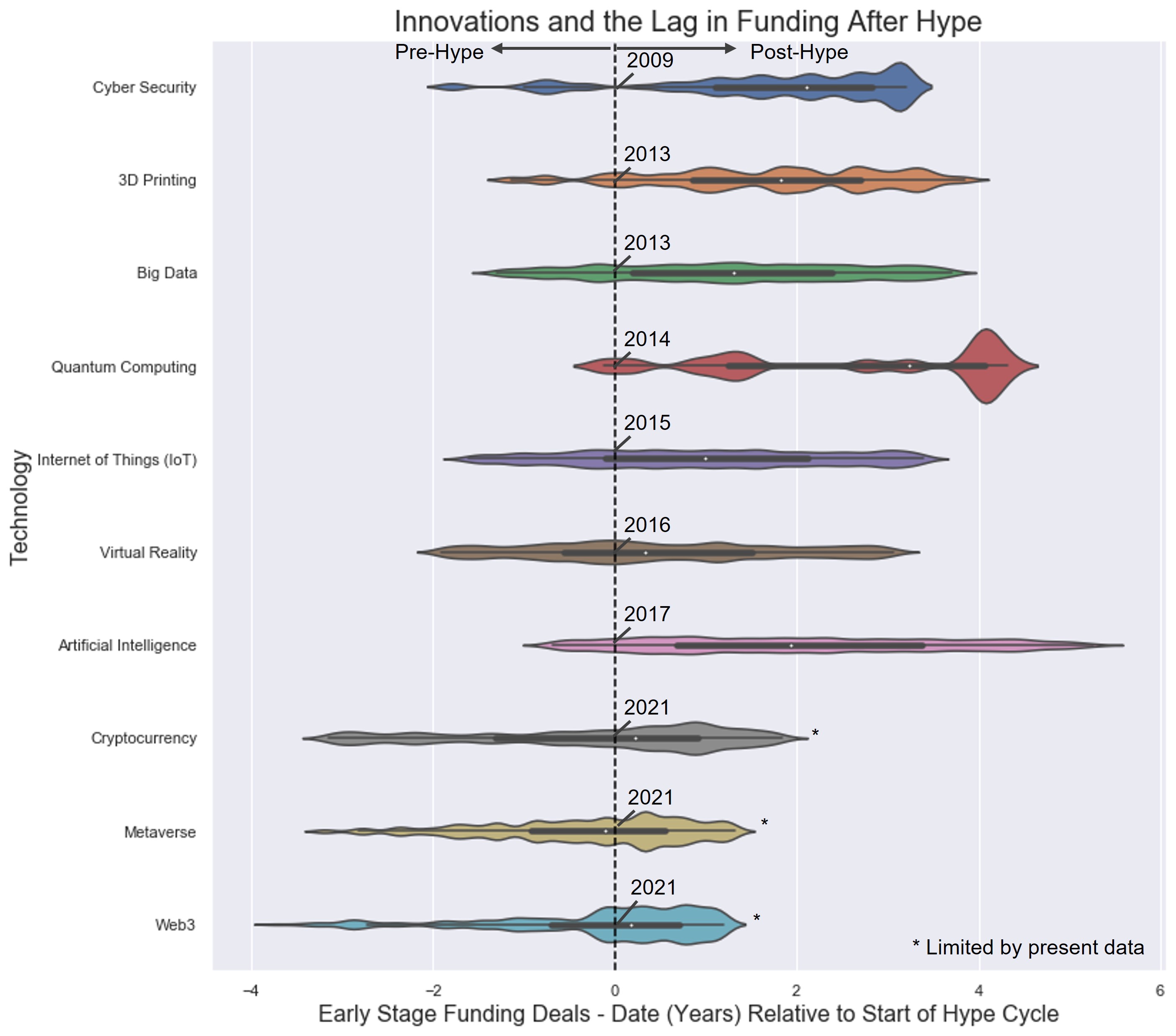

The plot below shows how the number of seed (including angel) fundraising deals evolved before and after the hype moment of the technology (as determined from Google Trends).

Figure 1: Violin plot of the timeline of seed deals for each technology relative to the start of its hype (x=0). The width represents the relative number of deals within a time period.

It was surprising to discover that the average fundraising-hype lag was 9.4 months, notwithstanding that VC deals typically take several months, approximately 3-6, to complete from pitch to close [3, 4, 5]. Consider that, in my definition, 'lag' refers to the interval between the hype moment and the point when fundraising start to peak. Plenty of deals close afterwards. This suggests that private equity investors may not sacrifice thoroughness in their due diligence process for the sake of expediency following a hype moment.

Some investors, however, clearly got ahead of the hype curves. As shown in the image above, deals did occur before interest peaked in the general public. That is to be expected. What will be interesting to assess in future work is if certain investors show a tendency of leading or lagging hype cycles.

Significant variability occurred between the technologies. Longer fundraising-hype lags can be associated with relatively more scientifically complex technologies, like quantum computing and artificial intelligence. This may be due to the expertise needed by investors and entrepreneurs. In contrast, shorter fundraising-hype lags occurred with more recent technologies, like Cryptocurrency, Metaverse and Web3. This may be due to lower barriers to entry, remote pitches during COVID [5] and greater amounts of venture capitalist “dry powder” (undeployed capital).

My analysis provides guidance for founders: hype doesn’t mean that you need to rush to start a company or raise funds. Often you have at least nine months to capitalize on momentum by raising funds, especially when your underlying technology is complex. You should, however, pay attention to the rate at which leading firms are investing in similar start-ups.

In summary, venture capitalists typically invest in a technology only after it is hyped, much like how you probably find out about hit TV shows. However, VCs’ interests in technologies take much longer to materialize than yours do as a consumer. In many cases, after a hype moment, several months pass before funding in early-stage start-ups kickstarts.

Methodology

My Python notebooks are stored in this public GitHub repository: dchataway/tech_funding_hype_analysis.

The general steps I followed in my analysis were the following:

- Selected technologies that were either classified as an “Organization Description” in Crunchbase or generated a reasonable sample with a keyword search in the “Organization Description”.

- For each technology, determined the first 'hype moment' by assessing the full history of Google Trends results (2004 – present) and identifying a week during which the search results peaked after an indefinite period of being near zero.

- Pulled Crunchbase funding round data and Google Trends results in the US over five (5) year periods for each technology, approximately centered on the initial hype moment identified in step 2.

- Filtered the data by ‘Equity Only Funding’ (Yes), Money Raised (>$1) and ‘Funding Stage’.

- Merged, consolidated, and normalized the data by week and then smoothed with a rolling average window of three (3).

- Identified peaks in both the total funding amounts and Google search results by week using the `scipy.signal.find_peaks` function with `height` = 0.6 and `distance` = 2 (tuned by eye).

- Created a column which indicated the date relative to the earliest peak in the Google search results (i.e. the “hype moment”).

- Defined the ‘time difference’ or ‘funding-hype-lag’ as [earliest date of peak hype – earliest date of peak fundraising].

Conclusions

The results of my analysis are shown below. Standard deviations are of the population. As can be seen, Angel and Seed funding appears quicker than for Series A and Series B funding (as to be expected since Series A and B round timing is more dependent on other factors and milestones).

|

Funding Round |

Average time difference between funding and hype |

Minimum time difference |

Maximum time difference |

|

Angel and Seed |

288 +/- 482 days or 0.8 +/- 1.3 years |

Cyber Security (-294 days or -0.8 years) |

Quantum Computing (1491 days or 4.1 years) |

|

Series A and Series B |

496 +/- 496 days or 1.3 +/- 1.3 years |

Metaverse (-308 days or -0.8 years) |

AI (1302 days or 3.6 years) |

The date of the earliest hype moment for each of the ten technologies is shown below, along with a citation or an anecdotal explanation for context.

|

Technology |

Date of initial hype moment |

Description |

|

Cyber Security |

2009-10-18 |

Presidential Proclamation - National Cybersecurity Awareness Month (10/01/2009) |

|

3D Printing |

2013-02-24 |

3D printing: Don’t believe the hype (06/21/2013) |

|

Big Data |

2013-04-21 |

Big Data: Big Hype? (02/04/2013) |

|

Quantum Computing |

2014-06-01 |

Microsoft Makes Bet Quantum Computing Is Next Breakthrough (2014/06/24) |

|

Internet of Things (IoT) |

2015-01-11 |

The Internet of Things: beyond the hype (01/08/2015) |

|

Virtual Reality |

2016-11-27 |

Return of the Virtual Reality Hype Cycle (What’s Different This Time?) (10/26/2016) |

|

Artificial Intelligence |

2017-09-10 |

“Gartner Hype Cycle for Emerging Technologies focuses on … Artificial intelligence (AI)…” (08/15/2017) |

|

Cryptocurrency |

2021-05-09 |

Elon Musk’s SNL appearance and dogecoin hit an all-time high of about 73 cents (05/08/2021) |

|

Metaverse |

2021-10-31 |

Facebook becomes Meta (10/28/2021) |

|

Web3 |

2021-12-26 |

"Welcome to 'Web3'. What is that?" (12/05/2021) |

Figure 2: Time-series data of normalized seed stage funding amounts and Google search results by technology, with additional information overlayed.

Future Work

I have categorized next steps for this analysis in three themes.

- Add rigor to the current analysis

- Add additional technologies to the sample.

- Apply statistical methods to the peak detection method and determination of the initial “hype moment”.

- Drive deeper insights

- Include data for additional “hype” signals such as, if possible, patent references, social media posts by venture capital firms and analyst publications.

- Identify if certain investors tend to lead or lag the hype cycle.

- Build a prediction model

- Use statistical and/or machine learning to predict fundraising cycles based on “hype signals”. I will be investigating the feasibility of using sequential models and recurrent neural network techniques.

References

Thank you to Ben Mason for his help in interpreting the Crunchbase data.

Header image modified from: Forbes.

[1] The Economist. January 16, 2023.

[2] The Economist. February 28, 2023.

[3] Harvard Business Review. March-April 2021.

[5] Jeff Bussgang. May 2, 2021.